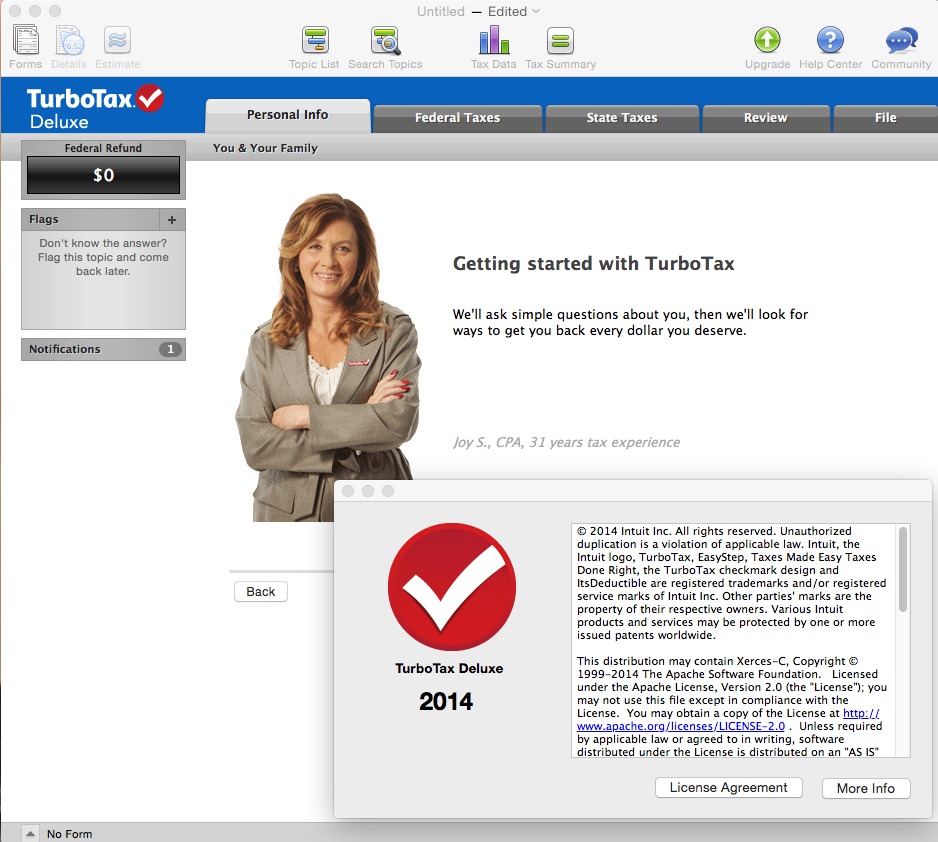

Intuit TurboTax Deluxe 2014.r02.007 Retail | MacOSX | 96.6 MB

ntuit TurboTax Deluxe maximizes your tax deductions searching for more than 350 tax deductions and credits. Get help with deducting mortgage interest and property taxes. Maximize charitable donations with ItsDeductible. Get help with reducing your risk of an audit with Audit Risk Meter. Get an extra 5% on top of your federal tax refund with our exclusive bonus and more!

– Get your taxes done right and your maximum refund

– Covers more than 350 tax deductions and credits (1040, Schedule A)

– Accurately deducts mortgage interest and property taxes

– Covers miscellaneous income and some related expenses (1099-MISC)

– Transfers info from last year’s TurboTax return

Every tax deduction and credit you deserve

We’ll ask you simple questions about your life. Based on your answers, we’ll search for more than 350 tax deductions and credits to get you the biggest tax refund—guaranteed.

Maximum tax deduction for your charitable donations

ItsDeductible™ (included) helps you accurately value items you donate to charity—no more guessing. Plus, track other donations such as cash, mileage, and stocks, to help you get every tax deduction you’re entitled to.

Big life changes this year? We can help

Change jobs? Get married? Buy a home? Have a baby? We’ll guide you through common life changes, explain how they impact your taxes, and find any new tax deductions and credits you may qualify for.

Track your audit risk

Our Audit Risk Meter™ checks your tax return for common audit triggers and shows whether your risk is high or low. Plus, get tips that will help reduce your chance of a tax audit.

Education tax credits (1098-E, 1098-T)

If you or your children attended college, trade school, or even took classes for work, we’ll help you find refund-boosting education tax credits and deductions for tuition, books, and student loan interest.

Extra guidance for homeowners

Your biggest purchase can also mean big deductions: mortgage interest, property taxes, refinancing fees, points, and improvements to your home’s energy efficiency.

Covers miscellaneous income and some related expenses (1099-MISC)

You have miscellaneous income (Sch C). Related deductions are limited to standard vehicle mileage, miscellaneous expenses up to $100, and phone expenses.

Requirements

Mac OS X v10.7.5 or later

Home Page – https://turbotax.intuit.com

Download uploaded

http://uploaded.net/file/ians9fyk/Tax.2014.r02.007.zip

Download rapidgator

http://rg.to/file/91463942ed11c8275e875ed9c2ef6e99/Tax.2014.r02.007.zip.html

Download 百度云

http://pan.baidu.com/s/1ntJXHW1

转载请注明:0daytown » Intuit TurboTax Deluxe 2014.r02.007 Retail MacOSX