Introduction to Associate Financial Planning

English | 2015 | mp4 | H264 1280×720 | AAC 2 ch | 138 MB

eLearning, Business, Finance

The Introduction to Financial Planning forms the basis for any learning related to Finance.

AFP stands for Associate Financial Planner. The AFP mark is a professional designation that is awarded to students who have successfully completed Module 1- Foundations in Financial Planning of the CFP certification education programme. AFP practitioners & individuals have been thoroughly trained and are competent to recommend general financial planning strategies and to advise on the appropriate selection and use of various financial products.

About the Associate Financial Planner (AFP) Certification

Statistics show that more and more people seek advice from financial planning professionals to alleviate the negative impact of unstable economies. Thus, because of these people, a career in financial planning will be filled with opportunities and challenges. However, even if many people turn to financial advisors for advice, the dilemma arises in choosing the right financial planner for them, as an increasing number of people in the financial services industry call themselves “financial advisers.” Therefore, there is a need for true financial planning professionals to differentiate themselves and demonstrate confidently that they are truly competent and capable.

This differentiation can be achieved by choosing to become an Associate Financial Planner (AFP®), a professional designation awarded by the Registered Financial Planners Philippines.

Become an Associate Financial Planner (AFP)

The public is looking for a financial planner who has demonstrated a commitment to competency, and financial professionals want an established certification that will sets them apart in the globally expanding financial planning profession. As an AFP, you can energize and revitalize your career by leveraging the knowledge and prestige associated with one of the world’s most recognized financial planning certification.

Benefits of the AFP Certification

– Immediate recognition from clients,peers and employers with AFP designation after your name

– Strict eligibility criteria means only a selected few are privileged to hold this designation.

– Provides a good starting point for professional who have the necessary skills sets and knowledge in basic personal financial planning.

– Provides an interim designation while you are pursuing the Registered Financial Planner (RFP) quantification in the future.

– Become part of the preeminent financial planning organization in the country, the Association of RFPs in the Philippines with numerous benefits, including access to technical sessions,events,seminars, and conferences.

Objectives of this programme:

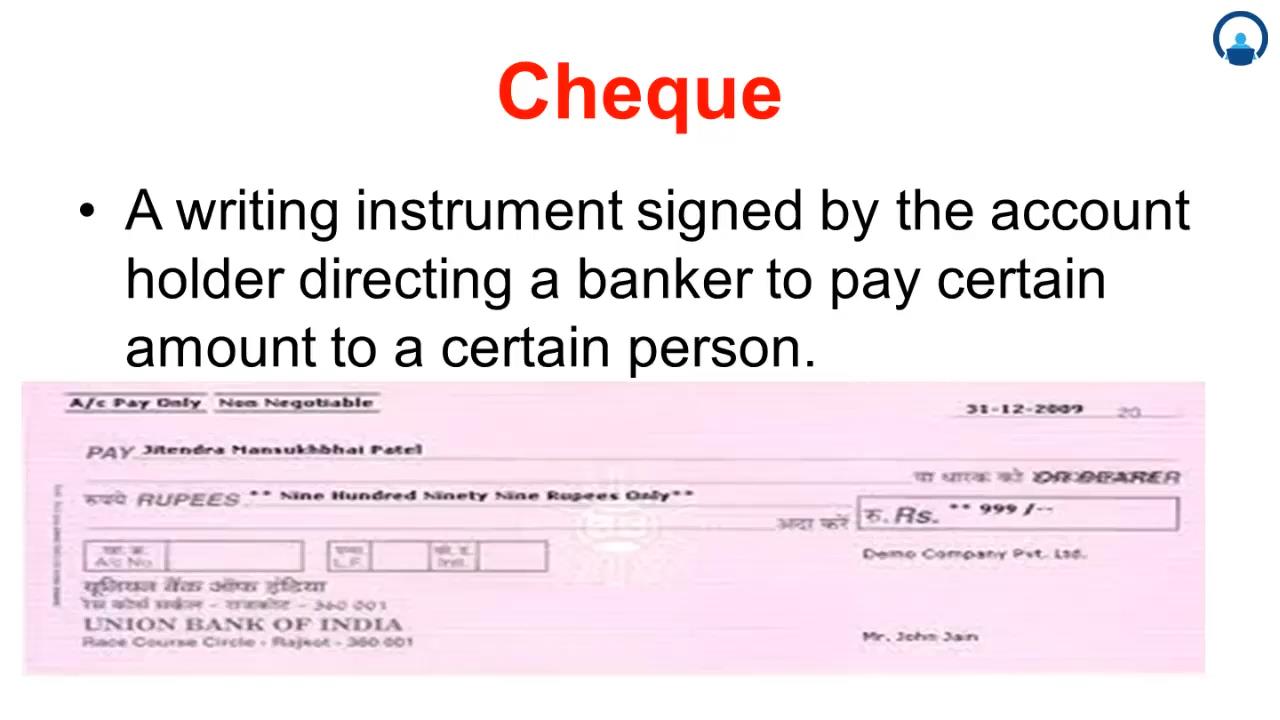

·To learn, understand and apply all aspects of the financial/ wealth planning process, including a review of the financial products and instruments

·Be equipped with financial concepts, tools and techniques to help make better informed personal financial decisions

·Gain insights to the management of your financial resources to achieve your desired lifestyle or retirement plan

·To meet your life goals through the proper management of your financial decisions

·Covers a broad range of professional financial topics that form the foundations of the career of any financial services professional

·Upon successful completion of the course, students are eligible to apply for the AFP certification after passing the certification examination

What are the requirements?

•Knowledge of Basic Finance terms

•A PC with internet

What am I going to get from this course?

•Over 7 lectures and 53 mins of content!

•To learn, understand and apply all aspects of the financial/ wealth planning process, including a review of the financial products and instruments

•Be equipped with financial concepts, tools and techniques to help make better informed personal financial decisions

•Gain insights to the management of your financial resources to achieve your desired lifestyle or retirement plan

•Covers a broad range of professional financial topics that form the foundations of the career of any financial services professional

What is the target audience?

•Financial Planners

•Finance Majors

•Students

•Professionals in Finance domain

AFP stands for Associate Financial Planner. The AFP mark is a professional designation that is awarded to students who have successfully completed Module 1- Foundations in Financial Planning of the CFP certification education programme. AFP practitioners & individuals have been thoroughly trained and are competent to recommend general financial planning strategies and to advise on the appropriate selection and use of various financial products.

About the Associate Financial Planner (AFP) Certification

Statistics show that more and more people seek advice from financial planning professionals to alleviate the negative impact of unstable economies. Thus, because of these people, a career in financial planning will be filled with opportunities and challenges. However, even if many people turn to financial advisors for advice, the dilemma arises in choosing the right financial planner for them, as an increasing number of people in the financial services industry call themselves “financial advisers.” Therefore, there is a need for true financial planning professionals to differentiate themselves and demonstrate confidently that they are truly competent and capable.

This differentiation can be achieved by choosing to become an Associate Financial Planner (AFP®), a professional designation awarded by the Registered Financial Planners Philippines.

Become an Associate Financial Planner (AFP)

The public is looking for a financial planner who has demonstrated a commitment to competency, and financial professionals want an established certification that will sets them apart in the globally expanding financial planning profession. As an AFP, you can energize and revitalize your career by leveraging the knowledge and prestige associated with one of the world’s most recognized financial planning certification.

Benefits of the AFP Certification

– Immediate recognition from clients,peers and employers with AFP designation after your name

– Strict eligibility criteria means only a selected few are privileged to hold this designation.

– Provides a good starting point for professional who have the necessary skills sets and knowledge in basic personal financial planning.

– Provides an interim designation while you are pursuing the Registered Financial Planner (RFP) quantification in the future.

– Become part of the preeminent financial planning organization in the country, the Association of RFPs in the Philippines with numerous benefits, including access to technical sessions,events,seminars, and conferences.

Objectives of this programme:

·To learn, understand and apply all aspects of the financial/ wealth planning process, including a review of the financial products and instruments

·Be equipped with financial concepts, tools and techniques to help make better informed personal financial decisions

·Gain insights to the management of your financial resources to achieve your desired lifestyle or retirement plan

·To meet your life goals through the proper management of your financial decisions

·Covers a broad range of professional financial topics that form the foundations of the career of any financial services professional

·Upon successful completion of the course, students are eligible to apply for the AFP certification after passing the certification examination

What are the requirements?

•Knowledge of Basic Finance terms

•A PC with internet

What am I going to get from this course?

•Over 7 lectures and 53 mins of content!

•To learn, understand and apply all aspects of the financial/ wealth planning process, including a review of the financial products and instruments

•Be equipped with financial concepts, tools and techniques to help make better informed personal financial decisions

•Gain insights to the management of your financial resources to achieve your desired lifestyle or retirement plan

•Covers a broad range of professional financial topics that form the foundations of the career of any financial services professional

What is the target audience?

•Financial Planners

•Finance Majors

•Students

•Professionals in Finance domain

Download uploaded

http://uploaded.net/file/u2nlez8q/IntroductionFPlanning.part1.rar

http://uploaded.net/file/0tba4plk/IntroductionFPlanning.part2.RAR

http://uploaded.net/file/u2nlez8q/IntroductionFPlanning.part1.rar

http://uploaded.net/file/0tba4plk/IntroductionFPlanning.part2.RAR

Download nitroflare

http://www.nitroflare.com/view/0113991060C01A1/IntroductionFPlanning.part1.rar

http://www.nitroflare.com/view/B714C9A1E84134D/IntroductionFPlanning.part2.rar

Download rapidgator

http://rg.to/file/aafd699c91b582c032f51ef050cc576c/IntroductionFPlanning.part1.rar.html

http://rg.to/file/96b4605da6c621e7ae1af84c9753edce/IntroductionFPlanning.part2.rar.html

Download 百度云

http://pan.baidu.com/s/1kT44SdT

转载请注明:0daytown » Introduction to Associate Financial Planning