Genre: eLearning | Language: English

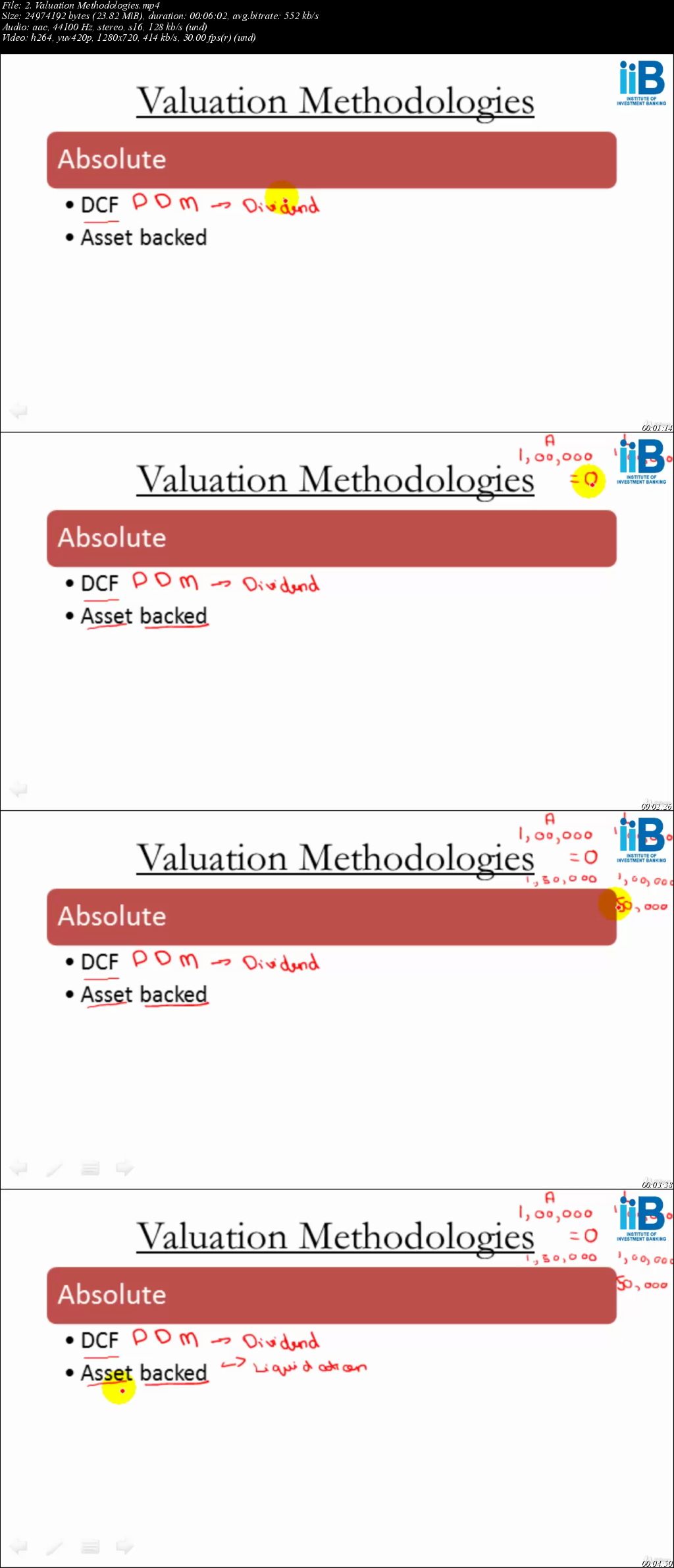

This course is dedicated to learning about this most commonly used DCF valuation techniques wherein you shall understand its techniques right from scratch on a financial model. One of the valuation methods Discounted Cash Flows (DCF) is used to determine the worth of investing. With the help of practical application and examples you shall understand different valuation methods available to investors, what is DCF? , where is it used, benefits of using DCF – comparability with other methods, projecting cash flows, determining levered and unlevered beta, calculating cost of equity, calculating after tax cost of debt, calculating WACC, calculating a terminal value using Gordon growth as well as the multiples method, discounting the cash flows at WACC, finding the per share intrinsic value, concluding the analysis, creating share price sensitivity tables and constructing a football field valuation

What are the requirements?

Basic knowledge of Finance concepts

Fundamental understanding of financial modeling

What am I going to get from this course?

Learn how to do DCF valuations on companies financial statements

Learn how to find the per share intrinsic value

Learn DCF Valuation techniques.

What is the target audience?

Financial Analysts

Students pursuing Degree, Diploma, Engineering and commerce who want to make a career in finance/Fixed Income market.

MBA in Finance, BBA in Finance

Password/解压密码-0daydown

Download nitroflare

http://nitroflare.com/view/10F197B65445C93/Discounted_Cash_Flow_-_DCF_Method_of_Valuation.part1.rar

http://nitroflare.com/view/C2E942AB2871188/Discounted_Cash_Flow_-_DCF_Method_of_Valuation.part2.rar

http://nitroflare.com/view/54B224FC77EE13E/Discounted_Cash_Flow_-_DCF_Method_of_Valuation.part3.rar

http://nitroflare.com/view/4936B1CCF0ACFE7/Discounted_Cash_Flow_-_DCF_Method_of_Valuation.part4.rar

Download 百度云

你是VIP 1个月(1 month)赞助会员,

转载请注明:0daytown » Discounted Cash Flow – DCF Method of Valuation